Protection and Insurance for People

Protection and Insurance for People. The death or illness of you or your partner would be hard enough for your loved ones to deal with, without having to cope with additional expenses. But putting plans in place now can lessen the financial strain that they may experience at an already difficult time.

As your Insurance Broker, we commit to undertake the following to provide you with the best possible service available:

- Conduct an analysis of your needs and risks and recommend to you the correct cover required to protect your assets and liabilities.

- Recommend the most appropriate Insurer to match your needs and risks.

- Only recommend financially secure Insurers to you.

- Provide alternatives on your risk retention through various excess options.

- Provide the option to pay your insurance premiums in monthly instalments.

- Provide you with prompt and timely servicing to ensure you are adequately informed of any issues that may affect your business.

- Provide you with an up to date version of your Policy Wording/s and, in the event of a claim: – Provide you with the correct Claim Form.

- Arrange for an assessor to be appointed if applicable.

- Assist you with completing your Claim Form.

- Submit your claim to your Insurer.

- Provide advice to ensure you receive your full entitlements under the Policy.

- Ensure your claim is settled in a fair and reasonable time frame.

Our team can assist you in finding the best policy to suit your family/individual needs, with no insurance jargon! Just honest and sound advice.

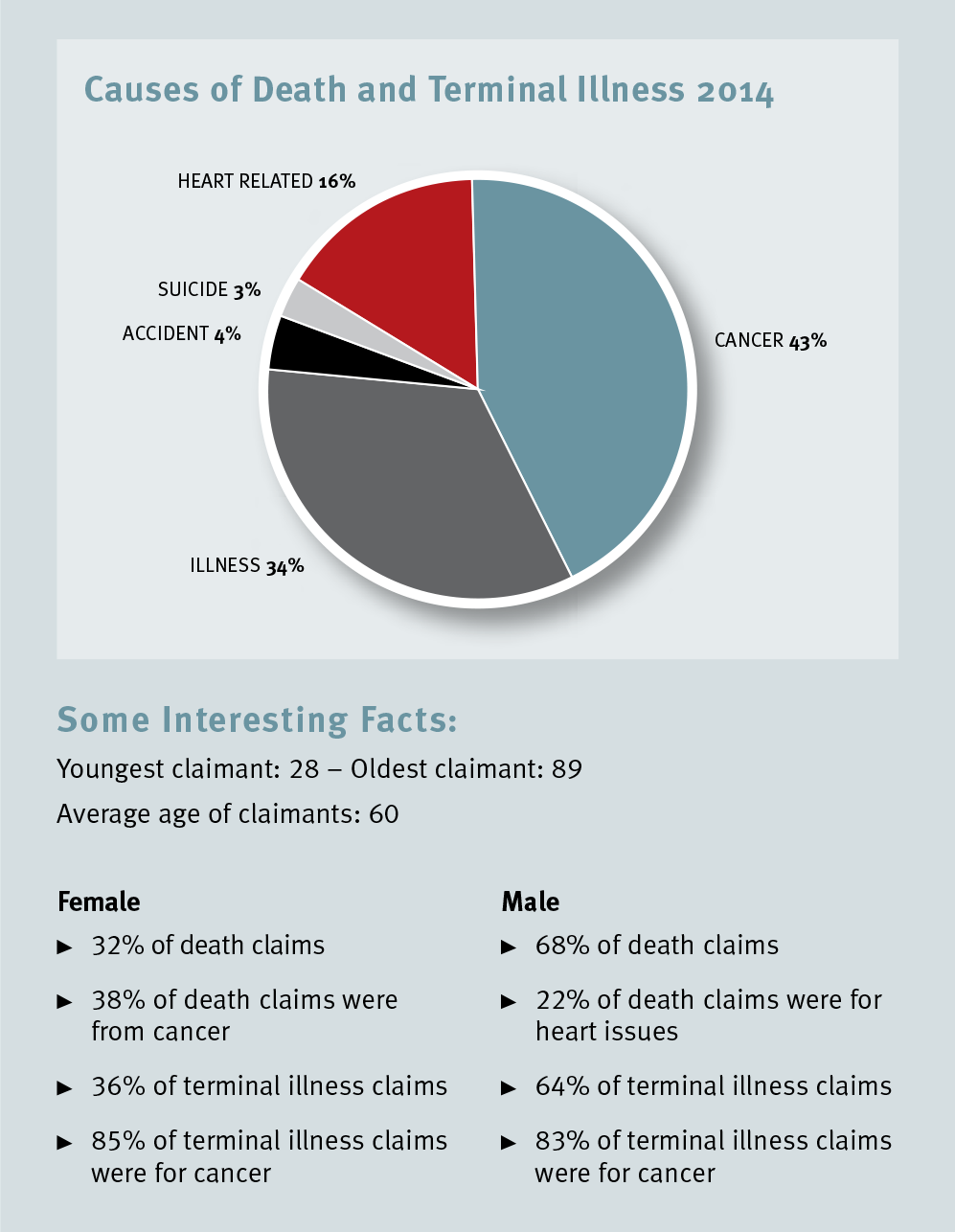

Life Insurance and Permanent Disability

Term Life Insurance provides for your family and dependents if you weren’t around, with a lump sum payment to provide for your family’s long-term financial requirements.

Permanent Disability insurance is a lump sum payment and while there are many different definitions, it is generally paid when you have been advised by a medical specialist that you will never work again.

It is important that you receive advice regarding the level and type of cover that you may require. Working with an adviser from AdAstra Financial Services, will ensure you have a qualified local contact to help you.

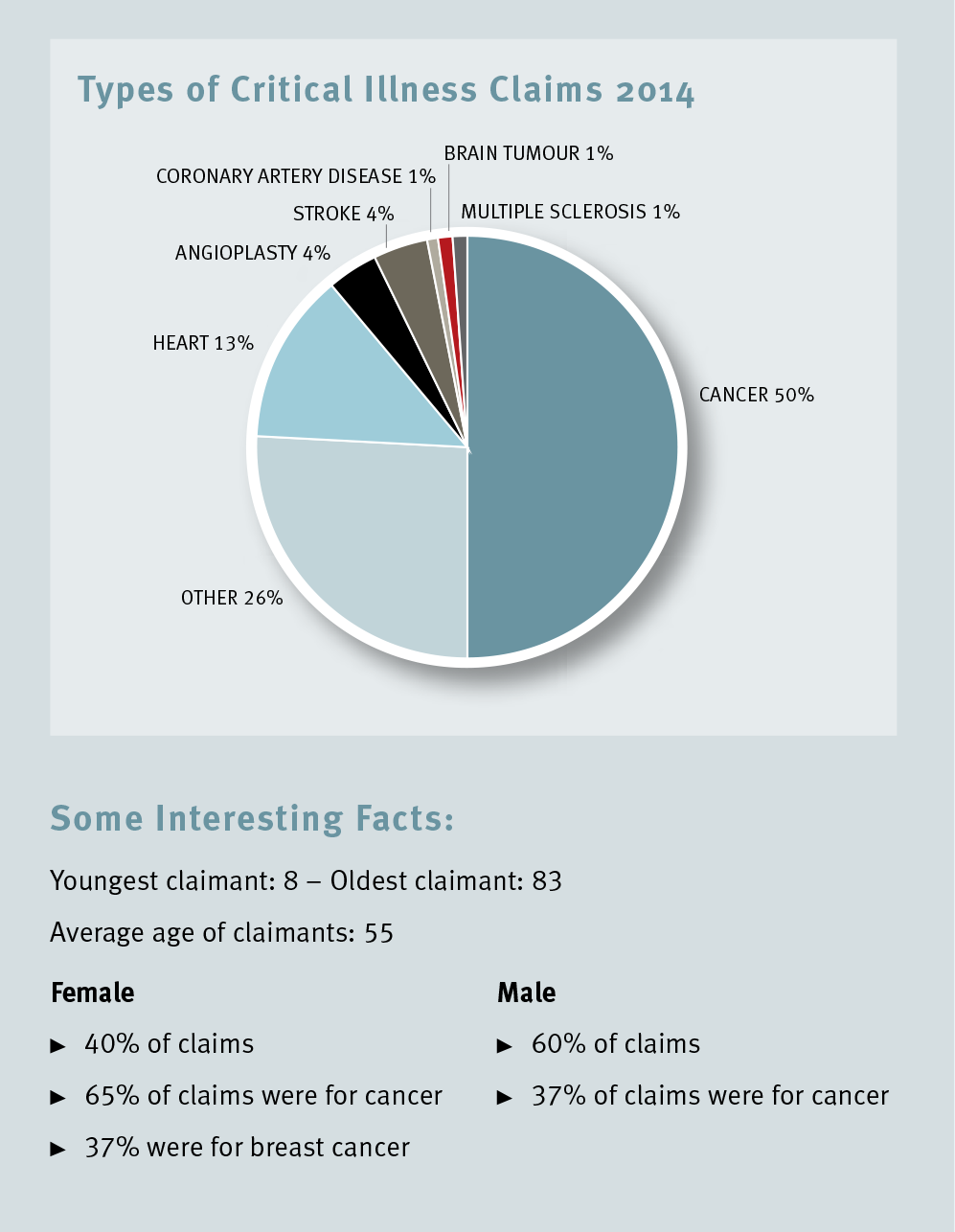

Trauma/Critical Illness Insurance

Who do you know that has suffered from a heart attack or cancer in their lifetime? No one ever expects it to happen to them, but imagine hearing the news that you have a serious medical condition. How would you cope financially during the recovery period? Would the financial stress hinder your progress?

Trauma Cover provides you with a one-off lump sum insurance payment if you’re diagnosed with one of the over 40 specified conditions as per your policy. Covered conditions vary between insurers but usually include things like cancer, heart attack, stroke intensive care, etc.

Our advisors will assist you in ensuring you have the right policy in place, giving you peace of mind.

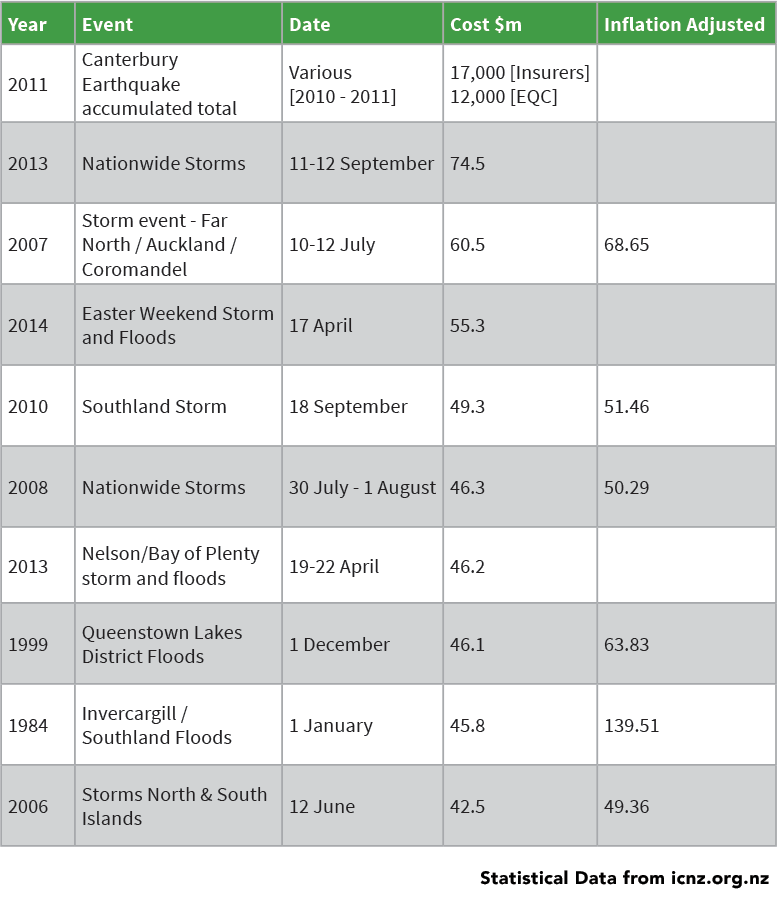

Rent / Mortgage cover

If due to ill health or an accident you are unable to work, this type of policy ensures your rent or mortgage is covered. You can insure up to 40% of your income or 110% of your mortgage payment, paid on top of ACC payments, ensuring you are still able to meet your obligations.

Income Protection Insurance

Your greatest asset is your ability to earn an income; after all it’s your ability to earn an income that will pay for your family home, your cars and children’s education.

Income Protection is a monthly benefit that pays you up to 80% of your income and covers you for accidents, illnesses or major traumas. It can pay you up until you return to work (after your waiting period), or if you cannot return, it pays right up to retirement age (currently being age 65).

A blend of professional experience and business attributes, we are committed to offering the best solutions for our clients

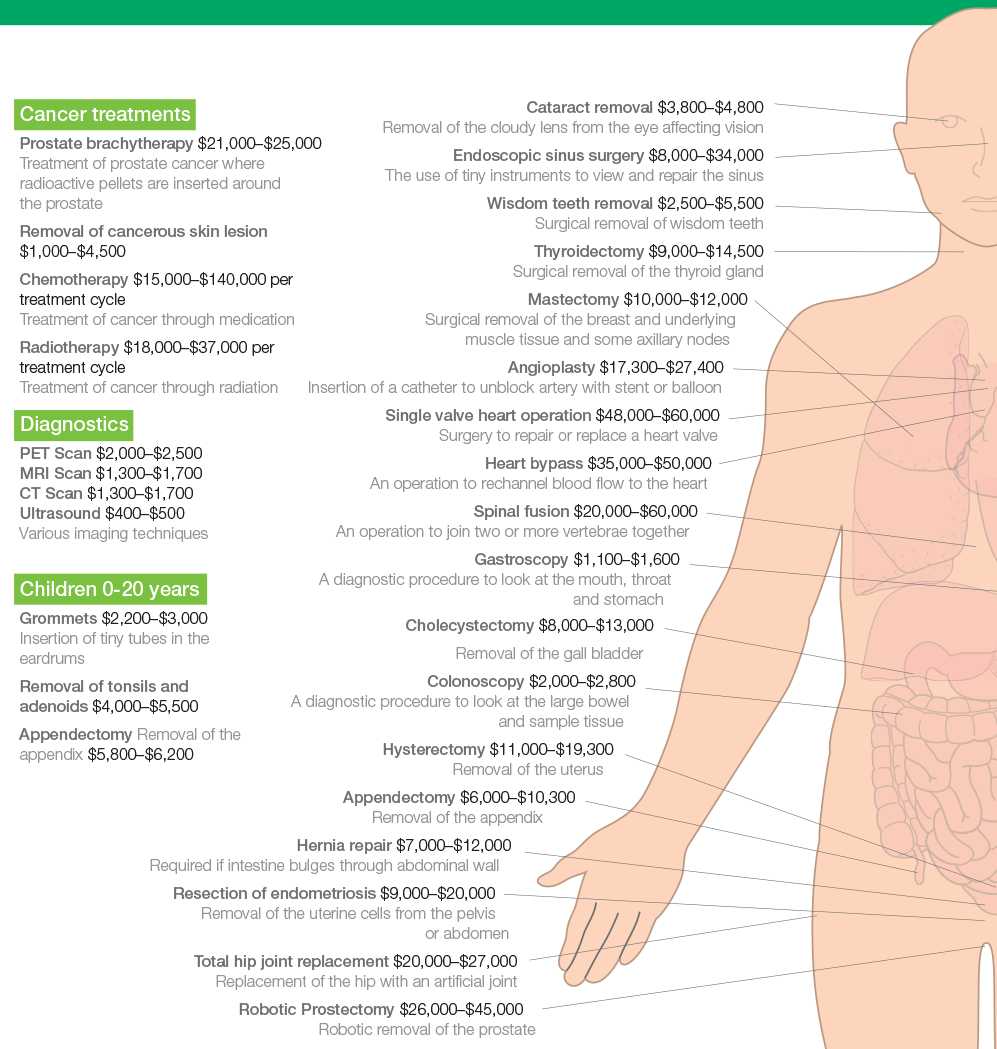

Health Insurance

Ill health can impact your life, lifestyle and earning ability – making health insurance a very important part of your life. Health insurance helps give you the security of knowing that you and your family have protection and options available should you, your partner or child experience a health problem.

Health insurance helps give you the security of knowing that you and your family have protection and options available should you, your partner or child experience a health problem.

Five important reasons to have health insurance:

- You have a greater choice of when, where and how you get treated, in consultation with your doctor.

- No added stress and worry about how to pay for your health bills.

- Avoid long delays in waiting for treatment in the public health system.

- Cover now for many unknown health issues that may arise in the future.

- Access to many of the latest recognised medical procedures and technology.

Get health insurance early

When you’re fit and healthy, it’s hard to imagine that you would ever suffer from a health problem. But if you purchase health insurance while you’re healthy, you will be covered for many of the health problems that you may encounter in the future. Some conditions may not be covered if you wait to purchase health insurance until after a condition appears – similar to how you would not be able to purchase insurance for your car if you have just had a crash.

Our Policies

We have access to a number of different health insurance policies for you to choose from depending on your needs. Many of our policies have added benefits such as travel and accommodation allowances (to help you when out of Taranaki for treatment), and some even allow for cash payment to be made on the diagnosis of major illnesses, as well as offering treatment. Your local adviser will both guide you through the decision making process and recommend a policy that will suit you and your loved ones. They will also be there if and when you need to make a claim, helping and supporting you through whatever the event may be.